As a real estate agent, your success isn’t just about closing deals—it’s about building lasting relationships with clients by helping them achieve their real estate goals. For investors looking to purchase and renovate properties, Fix and Flip loans provide a critical financing option.

By understanding how these loans work and incorporating them into your real estate strategy, you can add value to your services and attract more investor clients.

Fix and Flip loans for real estate agents are more than a financing tool; they’re a way for real estate agents to build trust, enhance credibility, and stand out in a competitive market. By becoming a knowledgeable resource on investor-friendly financing options, you position yourself as a trusted advisor who can guide clients through every stage of a flip—from securing funding to selling a fully renovated property.

How Fix and Flip Loans Empower Real Estate Agents and Investors

Fix and Flip loans are short-term, purpose-built financing solutions that allow investors to buy, renovate, and resell properties quickly. As a real estate agent, your role is critical in helping clients identify opportunities, navigate the loan process, and achieve successful outcomes. Property investors are repeat customers, which means a new stream of business for you.

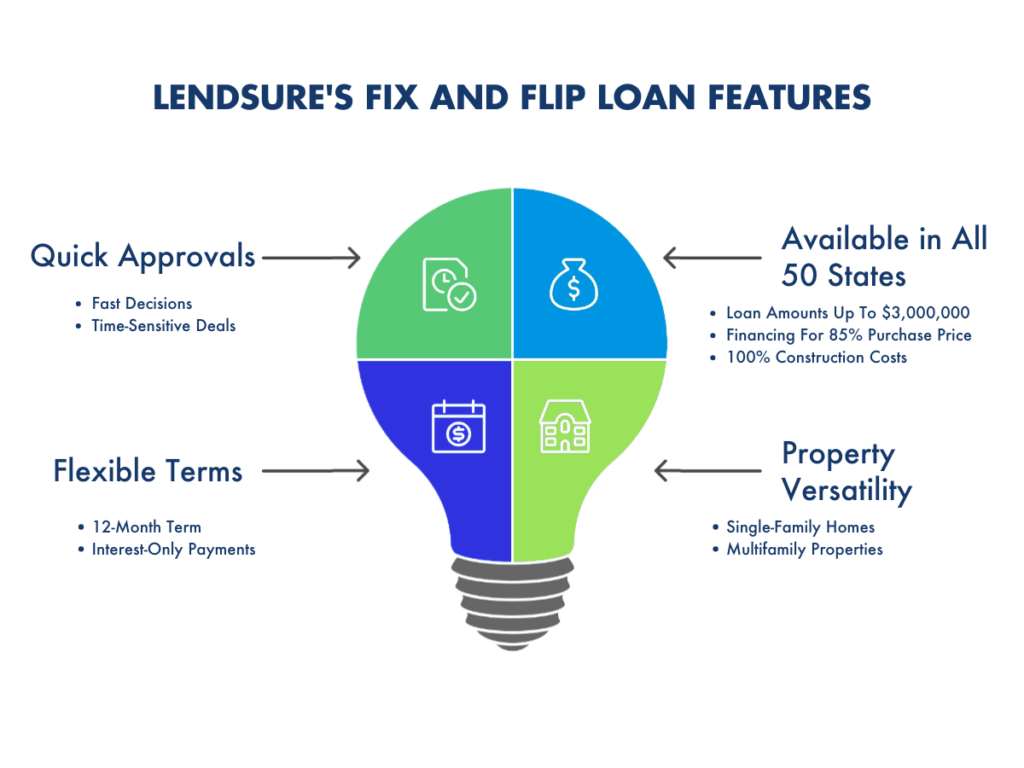

Here’s how LendSure Home Loans supports Fix and Flip loans for real estate agents:

- Quick Approvals: LendSure can issue decisions and term sheets typically in hours, not days, so your clients can secure funding fast and act on time-sensitive deals.

- Loan Size: Loan amounts up to $3,000,000, with financing for up to 85% of the purchase price and 100% of construction costs, ensure your clients have the capital they need to succeed.

- Flexible Terms: A 12-month loan term with interest-only payments gives clients the breathing room to complete renovations without cash flow pressure.

- Property Versatility: Whether your clients are targeting single-family homes or multifamily properties (up to 4 units), LendSure has options tailored to their needs.

By recommending LendSure’s real estate investment loan programs, you can ensure your clients have the tools they need to act decisively and maximize their investment potential.

Real estate agents as Strategic Partners for Investors

Your role as a real estate agent extends beyond finding properties and closing deals. By understanding the benefits of Fix and Flip loans, you can position yourself as a strategic partner who helps investors navigate the complexities of property flipping—while enhancing your own credibility, building trust, and gaining repeat business through your connection with a reliable lender.

To maximize your impact and support your clients effectively, consider these three key ways to add value:

1. Identifying High-Value Opportunities

With Fix and Flip loans, your clients can target undervalued properties that may not appeal to traditional buyers. Use your market expertise to identify homes with strong potential after repairs and renovations.

2. Simplifying the Loan Process

Understanding LendSure Home Loans’ streamlined loan process allows you to guide your clients through each step:

- Shorter application compared to traditional loans.

- Term sheets are issued typically within 24 hours.

- A collaborative review process with LendSure’s account managers and loan officers.

3. Building a Trusted Network

Connecting clients with LendSure and experienced contractors ensures their projects run smoothly. By offering access to reliable appraisers, inspectors, and contractors, you help clients streamline renovation timelines, build trust, and encourage repeat business.

How Real Estate Agents Can Leverage Fix and Flip Loans

- Earn Your Clients’ Confidence: Partnering with a trusted lender like LendSure gives your clients a smoother experience, helping you build stronger relationships and a solid reputation.

- Make Transactions Easier: Fast approvals and quick processing help you close deals efficiently, keeping your clients on track and reducing the stress of time-sensitive opportunities.

- Create Lasting Connections: Providing a seamless experience leaves a lasting impression, making clients more likely to recommend you and return for future deals.

- Attract Investor Clients: By promoting your knowledge of Fix and Flip loans, you can become the go-to real estate agent for investors. Offering insights into financing options positions you as a valuable partner, attracting both new and seasoned clients looking to fund up to 85% of the purchase price and 100% of renovation costs.

- Expand Your Market Reach: Fix and Flip loans open doors to more transaction types, allowing you to expand into markets focused on investment properties. This flexibility enables you to work with individual investors, investment groups, and real estate developers, boosting your income and professional network.

- Enhance Your Reputation: Guiding clients confidently through the financing, renovation, and resale process positions you as a trusted advisor. Your end-to-end support helps investors succeed and drives repeat business and referrals, solidifying your role as a key player in the investment property market.

The LendSure Home Loans Draw Process: A Win-Win for Real estate agents and Investors

LendSure’s Fix and Flip loans for real estate agents are structured to keep projects on track with a transparent draw process:

- Construction Progress Inspections: Ensures renovations align with plans.

- Paid Invoice Submissions: Clients are reimbursed for completed work, keeping cash flow consistent.

- Title Rundowns: Ensures clear title status at each stage, reducing risks.

This efficient process helps your clients stay focused on completing their flips, while you build a reputation as a real estate agent who helps investors succeed.

Leveling Up Your Business with Fix and Flip Loans

By integrating Fix and Flip loans for real estate agents into your service offerings, you can:

- Build stronger relationships with investor clients.

- Gain a competitive edge in the real estate market.

- Increase your transaction volume with repeat business and referrals.

Why Choose LendSure Home Loans?

It’s simple. We make loans that make sense. We’re not in-the-box lenders. Of course, there are numbers, ratios, and data to consider, but we know that behind every file, there’s an individual with unique circumstances seeking a loan.

We’re redefining the mortgage experience one loan at a time. Thanks to our common-sense approach and dedicated lending team, we say ‘yes’ more often to today’s homeowners and investors.

Contact us today to learn more about our Fix and Flip loans.