Real estate investors know that success often comes down to speed and strategy. Whether you’re buying your first property to flip or expanding your portfolio, having the right financing can make all the difference. That’s where Fix and Flip loans for investors come in—they’re designed to help you secure funding quickly, focus on your renovations, and turn undervalued properties into profitable investments.

LendSure Home Loans (“LendSure”) offers investor-friendly loan programs that make the process faster, easier, and more accessible. With flexible terms, fast approvals, and tailored solutions, our Fix and Flip loan program gives you the tools you need to stay ahead in today’s competitive market.

Why Choose LendSure’s Fix and Flip Loans for Investors?

LendSure’s investor-friendly loan programs are specifically designed to meet the unique needs of property investors.

Here’s what sets our Fix and Flip loans apart:

- Fast Approvals: Decisions and term sheets are typically issued in hours, not days, ensuring you can act quickly in a competitive market.

- High Loan-to-Cost Ratios: Finance up to 85% of the purchase price and 100% of construction costs, with total financing up to 85% of the total cost.

- Flexible Terms: With a 12-month loan term and interest-only payments, you can manage your cash flow while completing your project.

- Versatile Property Options: Finance single-family homes or multifamily properties (up to 4 units).

- Tailored for All Experience Levels: Whether you’re a first-time flipper or a seasoned investor, LendSure’s program is designed to work for you.

With loan amounts up to $1,000,000 and a minimum FICO score requirement of 660, these loans are accessible while offering the flexibility investors need to succeed.

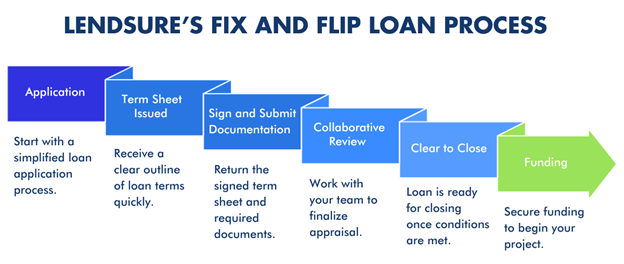

How LendSure’s Fix and Flip Loan Process Works

LendSure makes the financing process straightforward and efficient so investors can focus on their projects instead of paperwork.

- Application: Start with a simple Fix and Flip loan application, much shorter than the standard Uniform Residential loan application.

- Term Sheet Issued: Receive a clear outline of the loan terms typically in hours.

- Sign and Submit Documentation: Return the signed term sheet along with the required loan documentation.

- Collaborative Review: Borrowers work with the Loan Officer and you to address conditions and finalize the appraisal process.

- Clear to Close: Once all conditions are met, your loan is ready for closing.

- Funding: With funding secured, you’re ready to start your project.

The Draw Process: Smooth and Transparent

LendSure’s Fix and Flip loans for investors include a draw process that ensures funds are disbursed in stages as your project progresses. Here’s how it works:

- Construction Progress Inspection: An inspector evaluates the completed work.

- Paid Invoice Submission: Provide copies of invoices for the work you’ve completed and paid for.

- Title Rundowns: Each draw is verified with a title rundown to ensure clear status.

Reimbursements are typically based on a percentage of completed work, calculated using the loan-to-cost ratio. This structured process keeps your funding aligned with your project’s milestones, giving you the confidence to move forward efficiently.

Why Fix and Flip Loans Are Essential for Investors

Fix and Flip loans empower investors to move quickly and maximize their return on investment. Here’s why these loans are a game-changer:

- Speedy Access to Capital

With approvals in hours, our program allows investors to secure properties before the competition. This speed is critical in today’s fast-moving real estate market.

- Flexible Financing

The ability to finance up to 85% of the purchase price and 100% of renovation costs means investors can take on more ambitious projects with less upfront capital.

- Optimized Cash Flow

Interest-only payments during the 12-month loan term free up cash flow for project needs, ensuring smoother progress.

- Support for All Investor Levels

Whether you’re flipping your first property or scaling your portfolio, our program at LendSure is designed to adapt to your experience level and goals.

Tips for Making the Most of Fix and Flip Loans

To get the most out of Fix and Flip loans for investors, follow these best practices:

- Find High-Potential Properties: Look for undervalued or distressed properties with strong after-repair value (ARV).

- Create a Detailed Plan: Outline your renovation timeline and budget, focusing on upgrades that add the most value, like kitchens and bathrooms.

- Choose Reliable Contractors: Work with experienced professionals who can keep your project on track.

- Market Strategically: Highlight the property’s new features with professional staging and photography to attract buyers quickly.

When combined with LendSure’s investor-friendly loan programs, these strategies can help you turn your next property flip into a success.

LendSure: The Investor’s Partner in Success

LendSure Home Loans understands the unique challenges that real estate investors face. That’s why our Fix and Flip loans for investors are built for speed, flexibility, and success. With tailored solutions, fast funding, and a focus on investor needs, LendSure Home Loans is the financing partner you can count on.

Why Choose LendSure Home Loans?

It’s simple. We make loans that make sense. We’re not in-the-box lenders. Of course, there are numbers, ratios, and data to consider, but we know that behind every file, there’s an individual with unique circumstances seeking a loan.

We’re redefining the mortgage experience one loan at a time. Thanks to our common-sense approach and dedicated lending team, we say ‘yes’ more often to today’s homeowners and investors.

Contact us today to learn more about our Fix and Flip loans.